,

Schedule A Form 940 For 2024

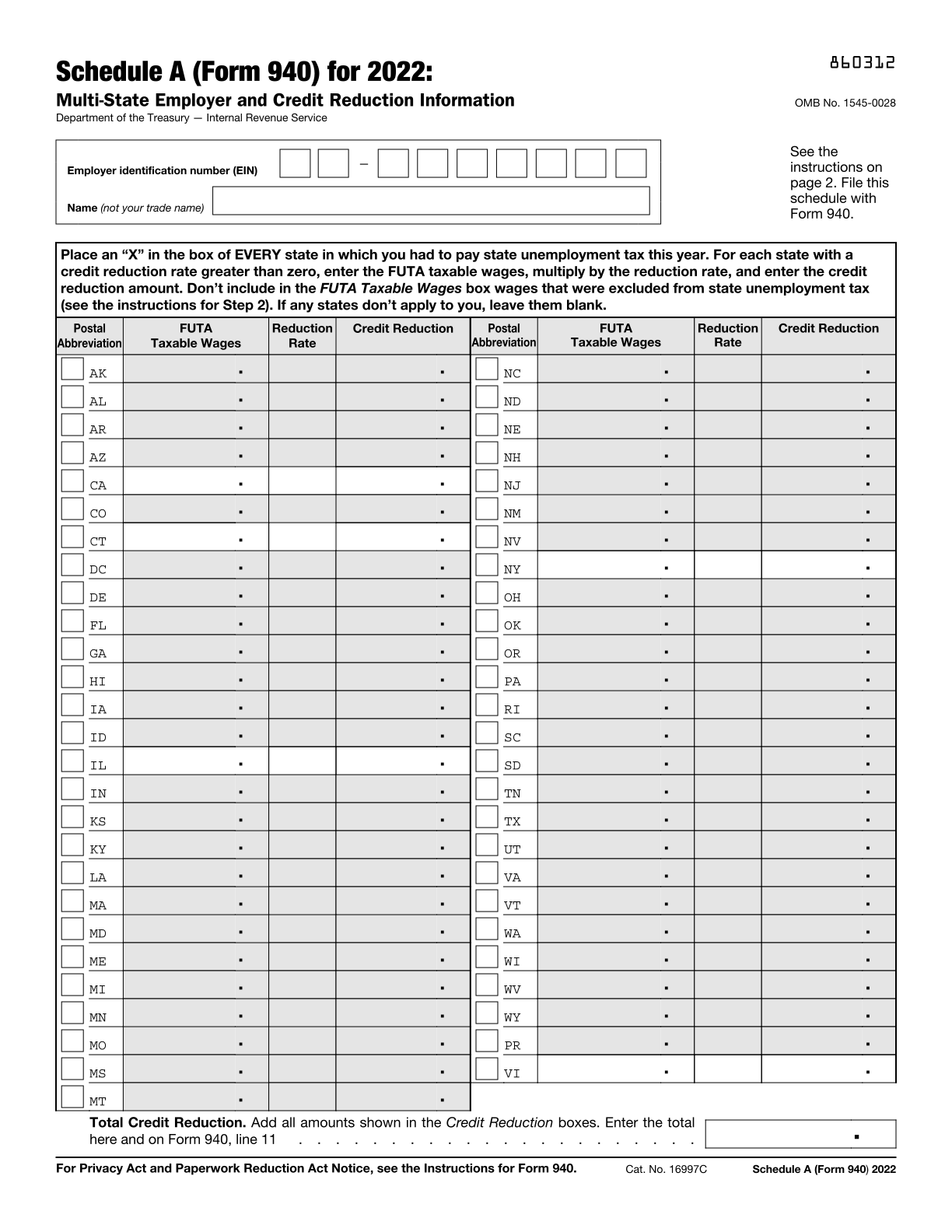

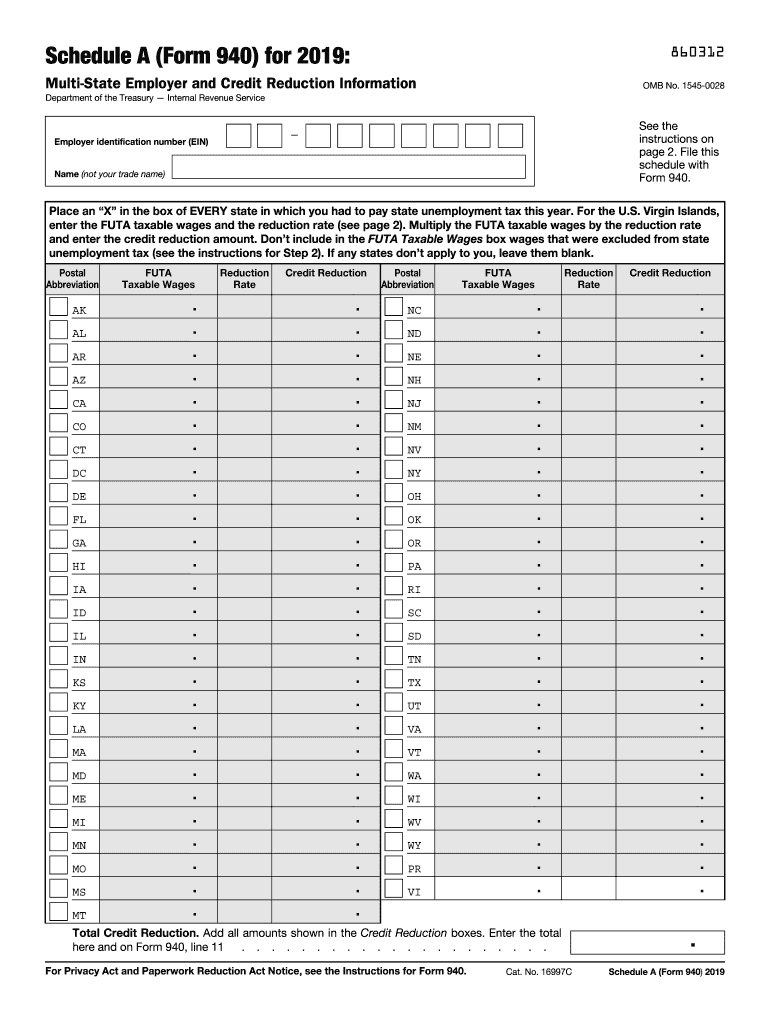

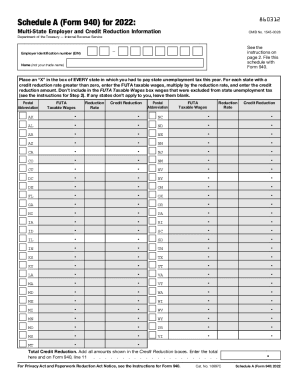

Schedule A Form 940 For 2024 – The partner or member uses this form, Schedule E and Form 1040 to calculate Refer to the Form 940 instructions on the IRS website to determine your credit for FUTA taxes. . You can claim this deduction on Form 1040, Schedule A. Do you pay property taxes monthly or yearly? In either case, both state and federal property taxes are tax deductible on your federal return. For .

Schedule A Form 940 For 2024

Source : hancock.inkForm 940 Instructions (2024 Guide) – Forbes Advisor

Source : www.forbes.comHow to Fill Out Form 940 | Instructions, Example, & More

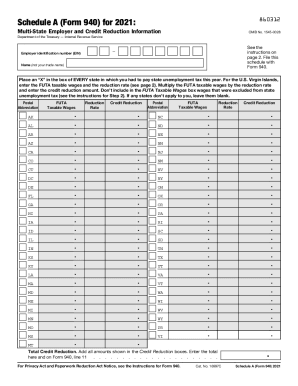

Source : www.patriotsoftware.comIRS Schedule A (940 form) | pdfFiller

Source : www.pdffiller.comForm 940 Instructions (2024 Guide) – Forbes Advisor

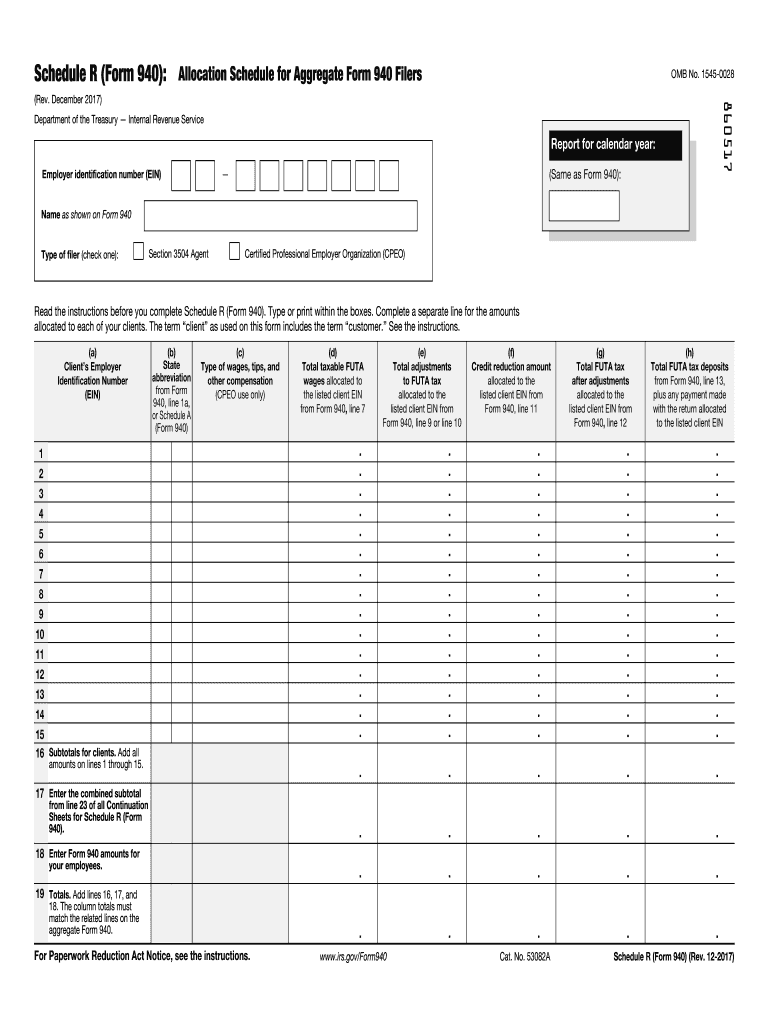

Source : www.forbes.com2017 2024 Form IRS 940 Schedule R Fill Online, Printable

Source : r-form.pdffiller.com2024 IRS Form 940: Annual Federal Unemployment BoomTax

Source : boomtax.comA Step By Step Guide to Completing Form 940 with TaxBandits | Blog

Source : blog.taxbandits.com2019 form 940: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 940 2022 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comSchedule A Form 940 For 2024 Schedule A (Form 940) (Multi State Employer and Credit Reduction : Household employers can opt to file and report FUTA taxes using Schedule H via Form 1040 instead of Form 940. Another varying set of requirements exists for agricultural or farming employers. . These Schedule K-1s report each shareholder’s to file an annual Federal Unemployment Tax Return each year on Form 940. If the corporation pays wages of $1,500 or more in any calendar quarter .

]]>